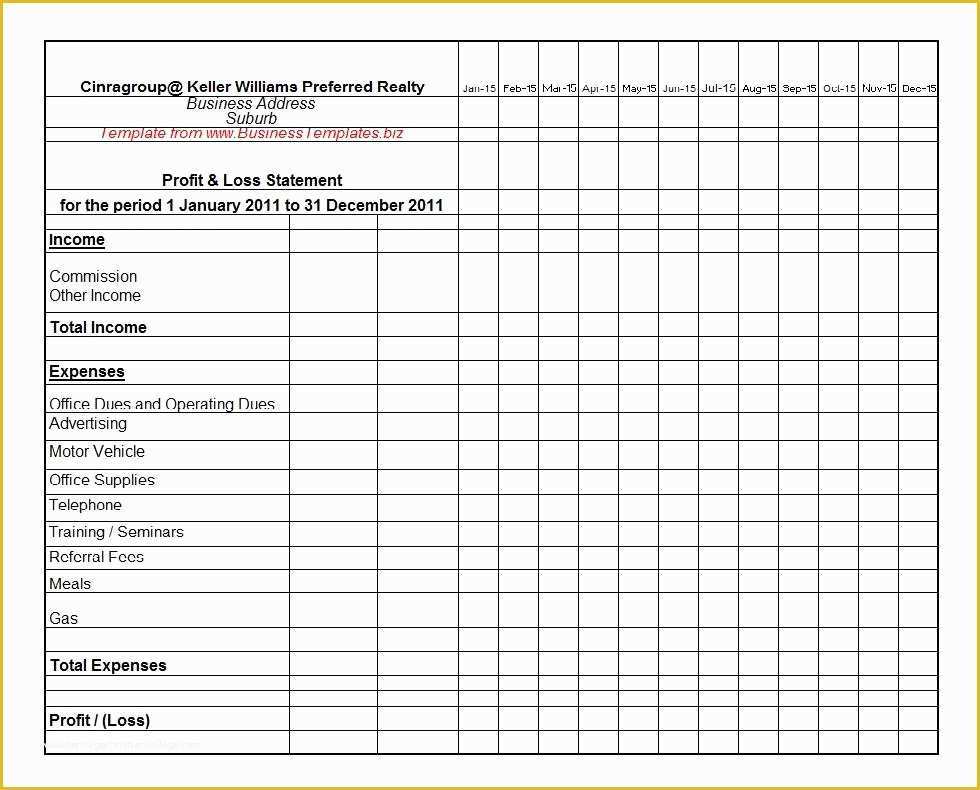

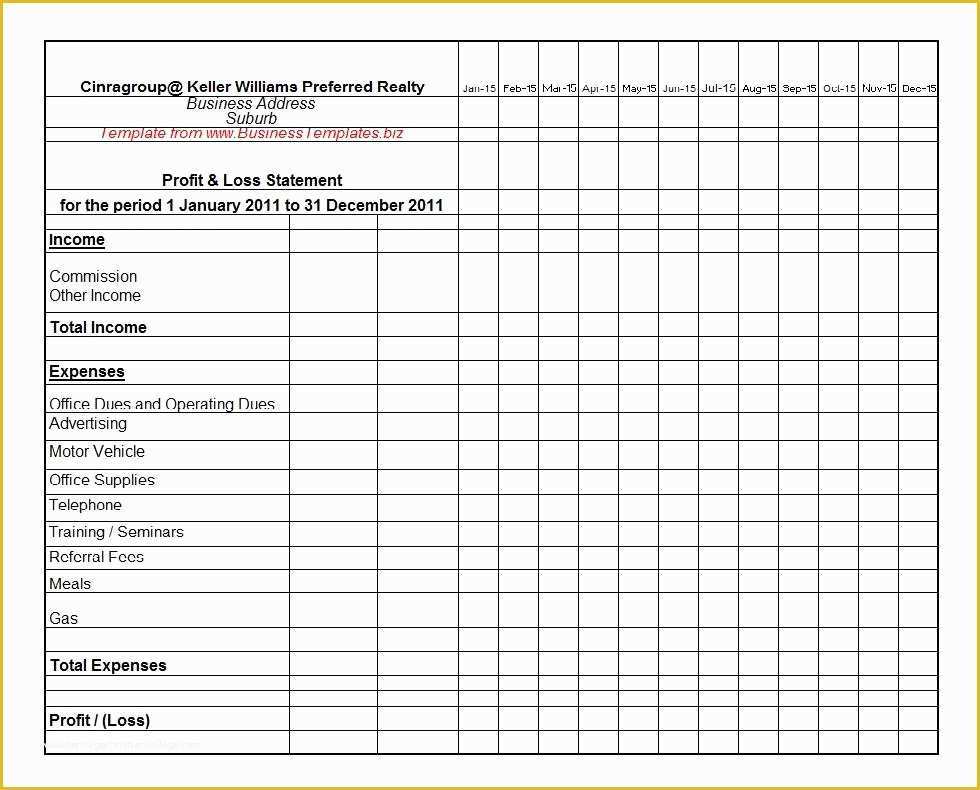

A P&L report goes to the manager in charge of each profit center these confidential profit. These reports are prepared as frequently as managers need them, usually monthly or quarterly perhaps even weekly in some businesses.

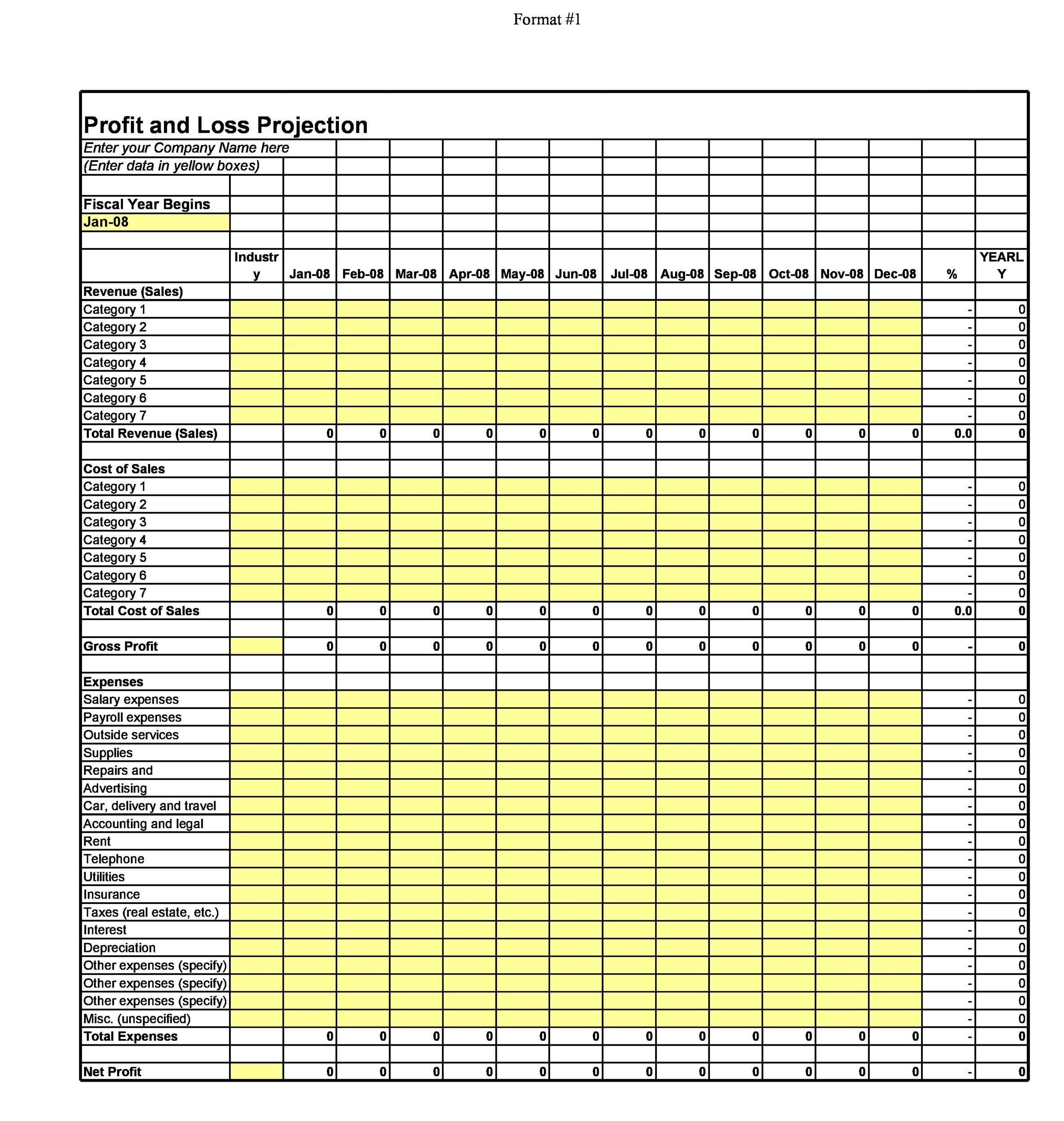

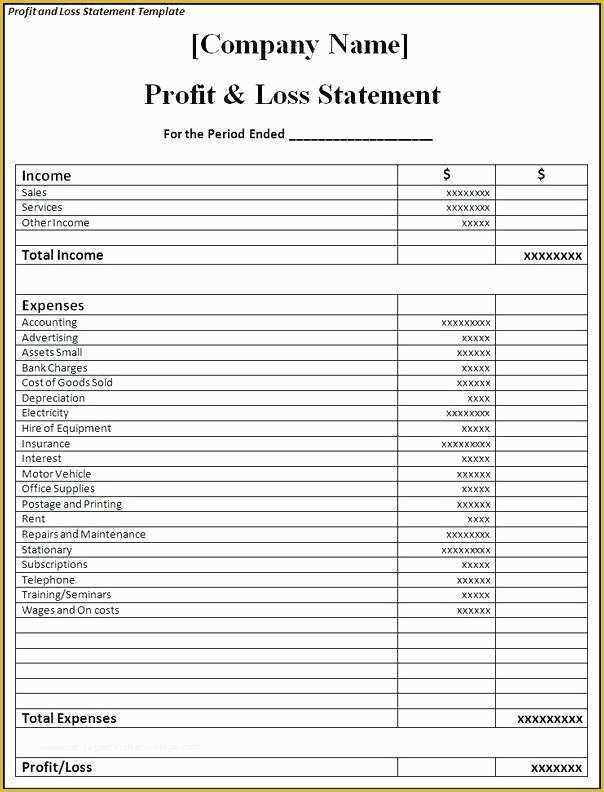

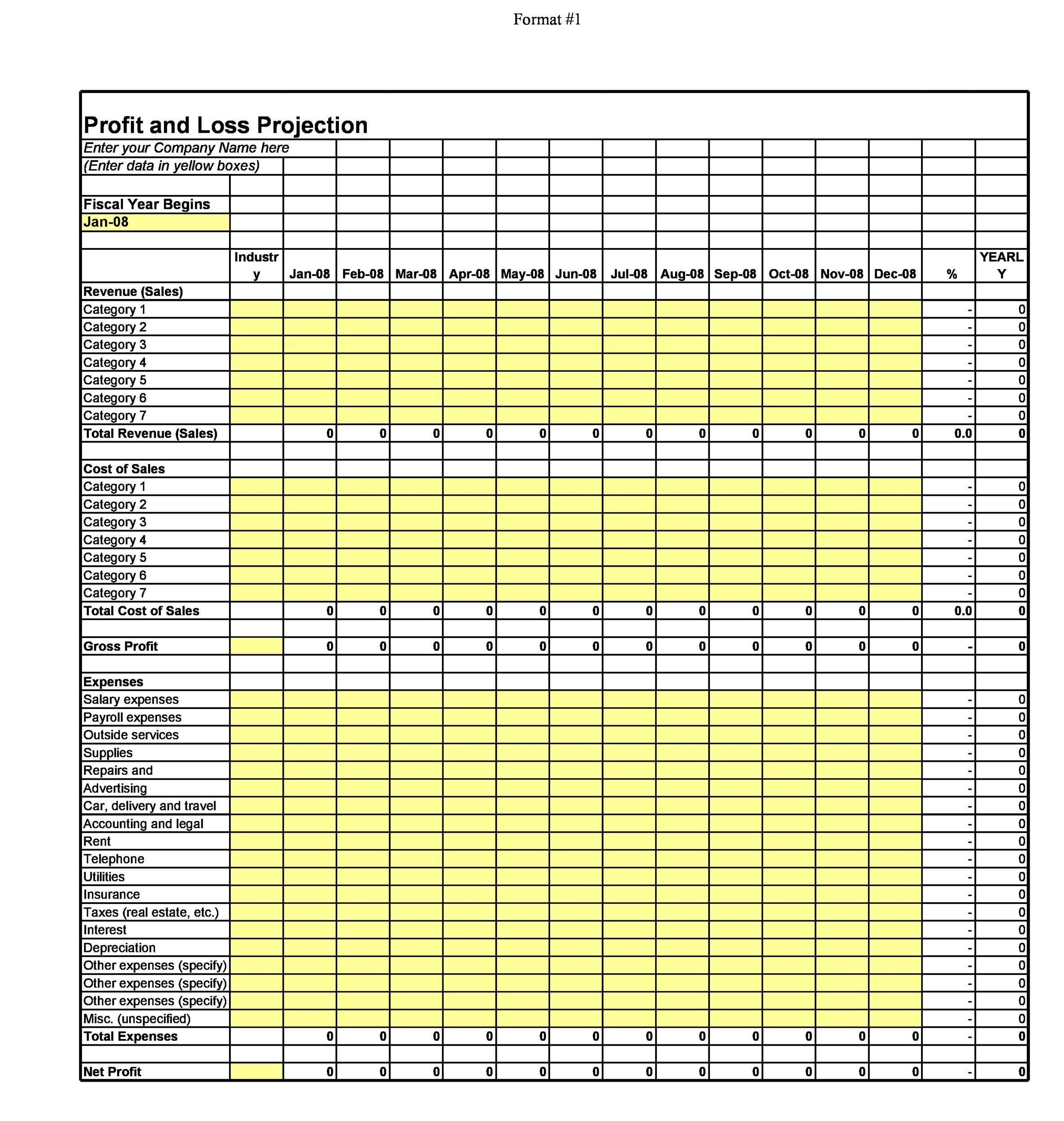

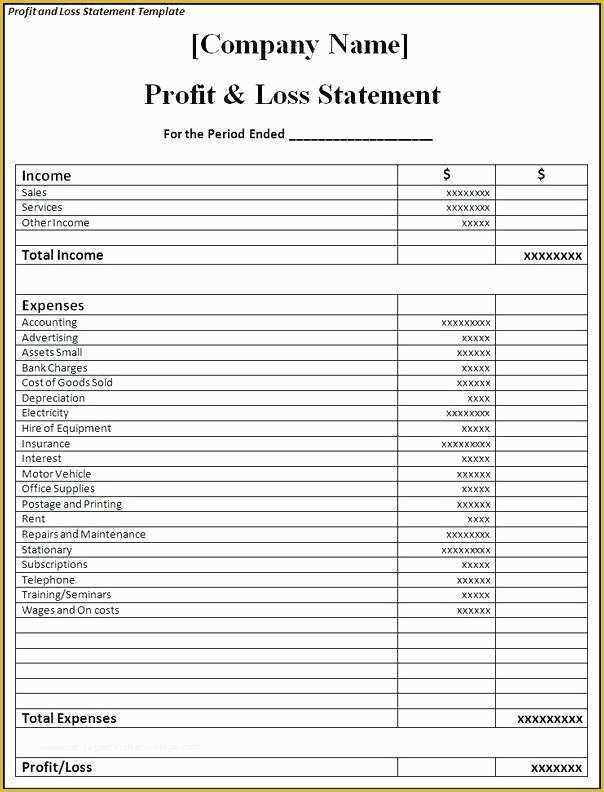

Payroll Category Transactions report (Plus and Premier, Australia only): See all pays recorded for a payroll category. Here you can choose your accounting method, how you want to display your figures and negative values, and what you want to display or hide in your report. Profit performance reports prepared for a business’s managers typically are called P&L (profit and loss) reports. The company has the policy to prepare a Profit and Loss Statement after the end of the financial year for the whole year. In India, there are two formats of P&L statements. Company ABC ltd is in the business of manufacturing and selling sports equipment in the market. You'll find this report in the Purchases tab in the Index to Reports window. Indian Companies must prepare the Profit & Loss Account as per Schedule III of the Companies Act, 2013. Bill Transactions report (Not Basics): See all transactions that relate to a bill, including payments and debits. You'll find this report in the Sales tab in the Index to Reports window. Invoice Transactions report: See all transactions that relate to an invoice, including payments and credits. You'll find this report in the Accounts tab in the Index to Reports window. Job Transactions report: See all transactions recorded for a job.

You can take a look at a transaction by clicking its details in the report. If you know the customer or supplier name, use the Card Transactions report.

Several reports can help you find a transaction.įor example, if you know the account associated with the transaction you are looking for, you can use the Account Transactions report. See also: Auditing your records and Accounts reports.

0 kommentar(er)

0 kommentar(er)